Seguros y Viajes en Automóvil: Cómo Estar Protegido en la Carretera con Trueway Insurance

No hay nada como la libertad de emprender un viaje por carretera, sentir el aire fresco y descubrir nuevos destinos a tu propio ritmo. Sin embargo, cualquier trayecto en automóvil puede conllevar ciertos riesgos, desde imprevistos mecánicos hasta accidentes inesperados. En Trueway Insurance, sabemos lo importante que es viajar con seguridad y tranquilidad, por eso […]

How Trueway Insurance Simplified Claims in 7 Easy Steps

Imagine this Florida homeowner nightmare: One morning, you wake up to discover a stream of water creeping through the bathroom door. The culprit? A burst pipe. You open the door, and to your dismay, everything – the walls, the floor, your personal belongings – is damaged. In a panic, you call up a local water […]

What Does A Notary Public Do And Do I Need One?

A notary public is an important part of any legal process. Trueway Insurance in Lake Worth knows how valuable a notary can be to the insurance process. They can verify an array of documents that are critical to processing claims, and they can prevent misunderstandings from occurring. We offer affordable insurance for car, home, and […]

What To Know About Getting Your International Driver’s License

When traveling abroad, being able to drive can be a valuable and useful asset. Having an International Drivers License is necessary for driving a motor vehicle when traveling outside of the US. You can obtain an international driving permit (IDP), which, when accompanied by a valid US driver’s license, will allow you to legally drive […]

Insurance Companies Want You to Know About Umbrella Insurance

When applying for a new insurance company, a lot of times the insurance companies ask you whether or not you want to enable umbrella insurance. When this happens, there are some who are completely clueless about what that means. If you are one of those individuals, Trueway Insurance is here to break it down for you. We […]

Making Sense of The Best Auto Insurance Policies for Commercial Business

Are you the owner of a business that actively uses vehicles in its daily functions? Finding the right company for commercial auto insurance can be tough. Luckily with Trueway Insurance, we offer the best auto insurance in Lake Worth. If you find yourself a little discouraged when it comes to what the best auto policies are, […]

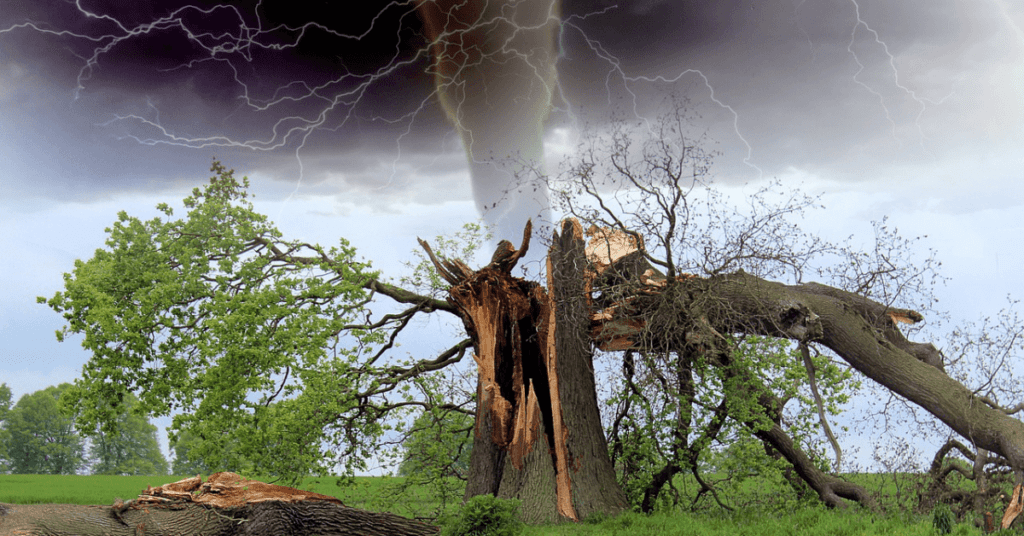

Insurance Companies Near Me Want to Prepare for Hurricane Season

We are nearing the end of , and the heat is quickly rising. What else does that mean for the state of Florida? It means that hurricane season is quickly approaching. At Trueway Insurance, our experts are here to make sure you are prepared for the worse this storm season. We take pride in being one […]

Cheap Auto Insurance Company Gives Tips to Lower Premiums

Some people think that if you find cheap auto insurance, then you are going to be sacrificing the coverage that you get, but this isn’t necessarily true. Trueway Insurance in the Lake Worth area is able to provide you with auto insurance quotes that won’t break the bank while giving you all the coverage you could need. […]